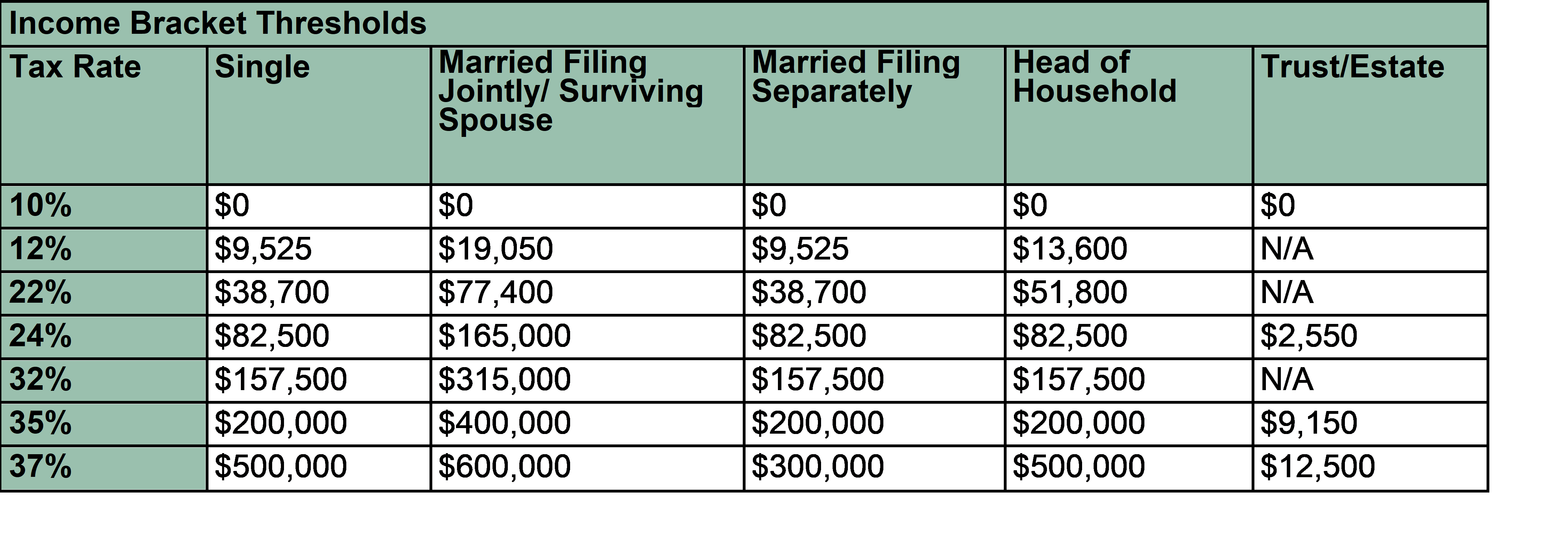

Wisconsin Tax Brackets for Tax Year 2021. Wisconsin is taxed at different rates within the given tax brackets and filing status. The tables below help demonstrate this concept. Wisconsin Tax Brackets for Tax Year 2022. Only the money you earn within a particular bracket is subject to the corresponding tax rate. It’s important to remember that moving up into a higher tax bracket does not mean that all of your income will be taxed at the higher rate. For tax year 2022, the lowest 10 rate applies to an individuals income of 10,275 or less, while the highest 37 rate applies to an individuals income of 539,900 or more. The tax rates for 2021 are: 10, 12, 22, 24, 32, 35, and 37. Taxable income is generally Adjusted Gross Income (AGI) less the standard or itemized deductions.

MFJ 2021 TAX BRACKETS FULL

If they owe more taxes than they had withheld, the taxpayer would owe the IRS a payment by April 17, 2023.Īgain, for a full review of the 2022 inflation adjustments in the tax code see here. There are seven tax rates that apply to seven brackets of income: 10, 12, 22, 24, 32, 35, and 37. Below are the tax brackets for 2021 taxable income. If they had more taxes withheld than what they owe, they would receive a refund. The taxpayer would then reconcile the total tax owed with the amount in taxes they had withheld by their employer. Take $4,807.50 (the amount of taxes the taxpayer owes on their first $41,775 in income).Identify the tax bracket the taxpayer falls in, the 22-percent bracket.Subtract the standard deduction of $12,950 from $60,000 in income, which equals $47,050.Here’s how a sample tax calculation might work for a single adult making $60,000 per year in 2022 and taking the standard deduction: This is done to prevent what is called bracket creep. 2016 Introduction Every year, the IRS adjusts more than 40 tax provisions for inflation. On your $10,276th dollar, you will start paying a 12-percent rate on each dollar, until you reach the next bracket at $41,775. Tax Foundation 1325 G Street, NW, Suite 950 Washington, DC 20005 202.464.6200 2017 Tax Brackets By Kyle Pomerleau Economist No. This means that, if you’re an individual earning income in 2022, you will pay a 10-percent rate on the first $10,275 you earn. Individual income tax rates are marginal. Married Tax Brackets and Standard DeductionĪ common misconception about federal tax liability and tax “brackets” is that once you enter a certain tax bracket, you pay the rate listed on all your income from dollar zero.

Single Tax Brackets and Standard Deduction The 2022 brackets are for income earned in 2022, which most people will file taxes on before April 15, 2023. For more on the tax brackets and income ranges visit our website at. Importantly, the 2021 brackets are for income earned in 2021, which most people will file taxes on before April 15, 2022. Lower 2018 Tax Brackets and Changed Income Ranges Major tax bracket changes occurred for 2018 and remain for 2019 with rates at 10, 12, 22, 24, 32, 35, and 37. See below for how these 2022 brackets compare to 2021 brackets. As a result, lawmakers adopted a "chained" CPI formula for post-2018 adjustments.The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets, the standard deduction, and other parts of the tax code. But if youre married, you get double the perks. You will fall into the 0 tax bracket if youre a single filer with taxable income under 40,401. However, some economists believe that formula doesn't fully account for changes in spending as prices rise. This is when the benefits really start pouring in. Previously, the tax brackets were adjusted based on the standard Consumer Price Index. One other thing that has changed is the indexing method used to adjust the tax brackets for inflation. See Also: 18 IRS Audit Red Flags Every Taxpayer Needs to Know

(Most of these rates were lowered by the Tax Cuts and Jobs Act of 2017.) However, as they are every year, the 2019 tax bracket ranges are updated, or "indexed," to account for inflation. The 2019 tax rates themselves are the same as the tax rates in effect for the 2018 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

For most taxpayers, that'll be your return for the 2019 tax year-which, by the way, will be due on April 15, 2020.

0 kommentar(er)

0 kommentar(er)